Trade analysis and trading advice for the European currency

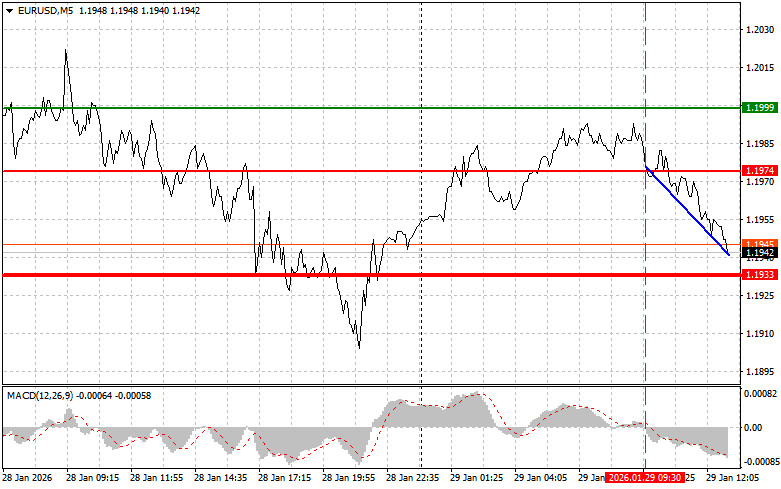

The test of the 1.1974 price level occurred at a moment when the MACD indicator was just beginning to move downward from the zero line, which confirmed a correct entry point for selling the euro. As a result, the pair fell by more than 30 points.

Lending volumes to businesses and households in the eurozone have also declined, which may well have had a negative impact on the euro. The reduction in lending may be the result of a more cautious policy by the European Central Bank, which last year refrained from cutting interest rates in its fight against inflation and continues to adhere to a similar strategy.

The focus now shifts to the second half of the day, when U.S. data on jobless claims, the trade balance, and the volume of factory orders are expected. These indicators traditionally affect market conditions, and today will likely be no exception. Initial jobless claims act as a barometer of the health of the U.S. labor market. A decline in such claims is usually a sign of economic strengthening, which could prompt the Fed to continue holding rates. The trade balance shows the difference between exported and imported goods and services, while factory orders are an important predictor of business activity in the manufacturing sector. An improvement in these indicators would support the U.S. dollar against the European currency.

As for the intraday strategy, I will rely more on the implementation of Scenarios No. 1 and No. 2.

Buy Signal

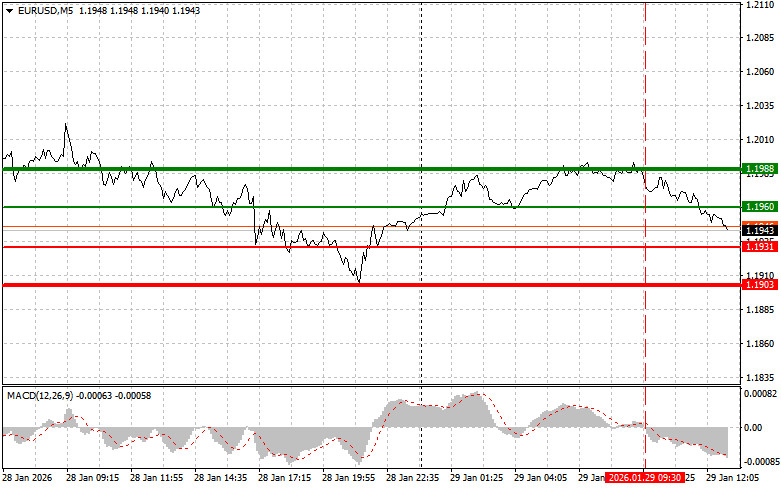

Scenario No. 1: Today, buying the euro is possible if the price reaches the level around 1.1960 (green line on the chart), with a target of growth to the 1.1988 level. At 1.1988, I plan to exit the market and also sell the euro in the opposite direction, expecting a move of 30–35 points from the entry point. Strong euro growth should be expected only after weak economic data.Important: Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario No. 2: I also plan to buy the euro today in the event of two consecutive tests of the 1.1931 price level while the MACD indicator is in the oversold area. This would limit the pair's downward potential and lead to a reversal of the market upward. A rise toward the opposite levels of 1.1960 and 1.1988 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the euro after the price reaches the 1.1931 level (red line on the chart). The target will be the 1.1903 level, where I plan to exit the market and immediately buy in the opposite direction (expecting a move of 20–25 points in the opposite direction from that level). Pressure on the pair will return in the event of strong economic data.Important: Before selling, make sure the MACD indicator is below the zero line and just starting to decline from it.

Scenario No. 2: I also plan to sell the euro today in the event of two consecutive tests of the 1.1960 price level while the MACD indicator is in the overbought area. This would limit the pair's upward potential and lead to a reversal of the market downward. A decline toward the opposite levels of 1.1931 and 1.1903 can be expected.

What's on the Chart:

- Thin green line – entry price at which the trading instrument can be bought;

- Thick green line – estimated price at which Take Profit orders can be placed or profits can be taken manually, as further growth above this level is unlikely;

- Thin red line – entry price at which the trading instrument can be sold;

- Thick red line – estimated price at which Take Profit orders can be placed or profits can be taken manually, as further decline below this level is unlikely;

- MACD indicator. When entering the market, it is important to rely on overbought and oversold zones.

Important: Beginner Forex traders should be very cautious when making market entry decisions. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for an intraday trader.